Aspen Corporate Financial Planning - Investment Philosophy

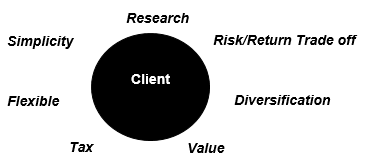

Our Investment Philosophy is the theory and attitudes that act as our guiding principles behind the behaviour when we take actions to invest. Our Investment Philosophy centres on client needs, wants, goals, objectives and priorities.

Investment Philosophy Goal

The goal of our Investment Philosophy is to provide our clients with investments that are in line with their strategy and provides as much certainty as possible to achieving intended outcomes. We want to ensure long term protection of capital by implementing our approach.

Our Process

Our Investment Philosophy process determines the actions we take. There are 7 key principles that guide our process:

Research

We place the utmost importance on independent research in formulating the basis for investment recommendations. Our research helps to evaluate investments ability to provide the desired outcomes.

Risk/Return trade off

Asset allocation drives the majority of investment return and how much risk (volatility) will be incurred. We test client risk/return profiles to allocate investments individually tailored to client strategies.

Diversification – Risk management

Diversification is a key factor to risk management in our investment process. Put simply "do not put all of your eggs in one basket". We employ a research-backed approach to investment and asset class diversification to manage the risk.

Simplicity

We do not believe in complexity just for the sake of it, or to try to look smart. Investments that are easy to explain and help clients understand what we are doing are an important part of client educating. If you understand something, it will be a much more comfortable journey for everyone.

Flexibility

Things change so it is important that client's investment strategies can too. We value investments and strategies that allow flexibility to change when we need to.

Value

Fees and costs matter. We take a value based approached and critically appraise the after fees and costs value of investments that we recommend.

Tax

We understand that after tax outcomes are more important than gross returns. How much profit ends up in your pocket and not the taxman's? We relevant work with expert accounting partners to ensure good client outcomes after tax.